How to Calculate Your Subscription Expenses?

Learn how to calculate your subscription expenses and effectively manage your personal finances.

More and more subscriptions exist, whether to access streaming services, educational platforms or meditation, it's easy to encounter a variety of subscriptions that can impact your finances. That's why it's important to understand how to calcular tus gastos en suscripciones and maintain proper control sobre tus suscripciones.

Understanding Your Subscriptions

Before you start calculating your subscription expenses, it's crucial to have clarity about what exactly a subscription is and what types exist. A subscription is a service or product that you subscribe to through periodic payment, usually monthly or annually.

There are different types of subscriptions that you should take into account. Some are automatically renewable, which means they renew automatically unless you cancel them.

Keep in mind that subscriptions can be an excellent way to access services and products conveniently and often at a cheaper price than if you purchased them separately. However, it's also essential to have control sobre tus suscripciones to evitar gastos innecesarios and ensure you're getting the máximo valor por tu dinero.

A useful strategy for managing your subscriptions is tracking all of them in a list or on a spreadsheet. This will allow you to have a clear view of how much you're spending on subscriptions and when they renew. You can also use apps or online services that help manage your subscriptions by sending reminders when the renewal date approaches.

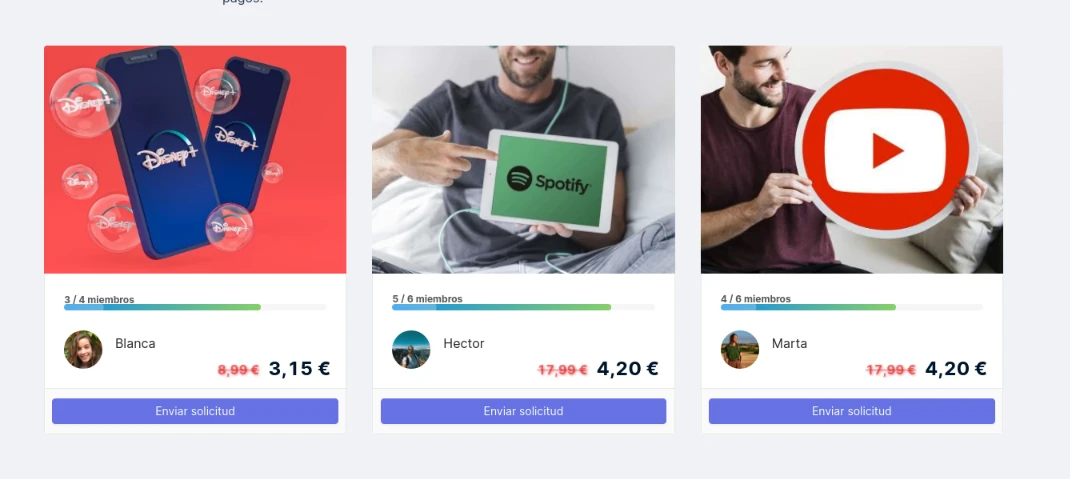

Additionally, it's advisable to look for others with whom you can share the cost of a subscription; this way, you can access more subscription platforms while paying much less.

Steps for Calculating Your Subscription Expenses

Once you understand the basics about subscriptions, it's time to calculate your expenses. Here are some steps that will help in this process:

Identify All Your Subscriptions

The first thing you should do is identify all the subscriptions you are subscribed to. Make a detailed list of each service or product accessed through a subscription. Don't forget to include those subscriptions that might be less obvious, like loyalty program memberships or online education platforms.

After identifying all your subscriptions, it’s also useful to classify them into categories such as entertainment, lifestyle, basic services, among others. This will help visualize your expenses better and identify potential areas where you could reduce your subscriptions.

For example, in the entertainment category, you might have streaming service subscriptions like Netflix, Amazon Prime Video, and Spotify. In the lifestyle category could include magazine subscriptions or food delivery services. In basic services might include internet services, mobile telephony or electricity.

Add Up the Costs of Subscriptions

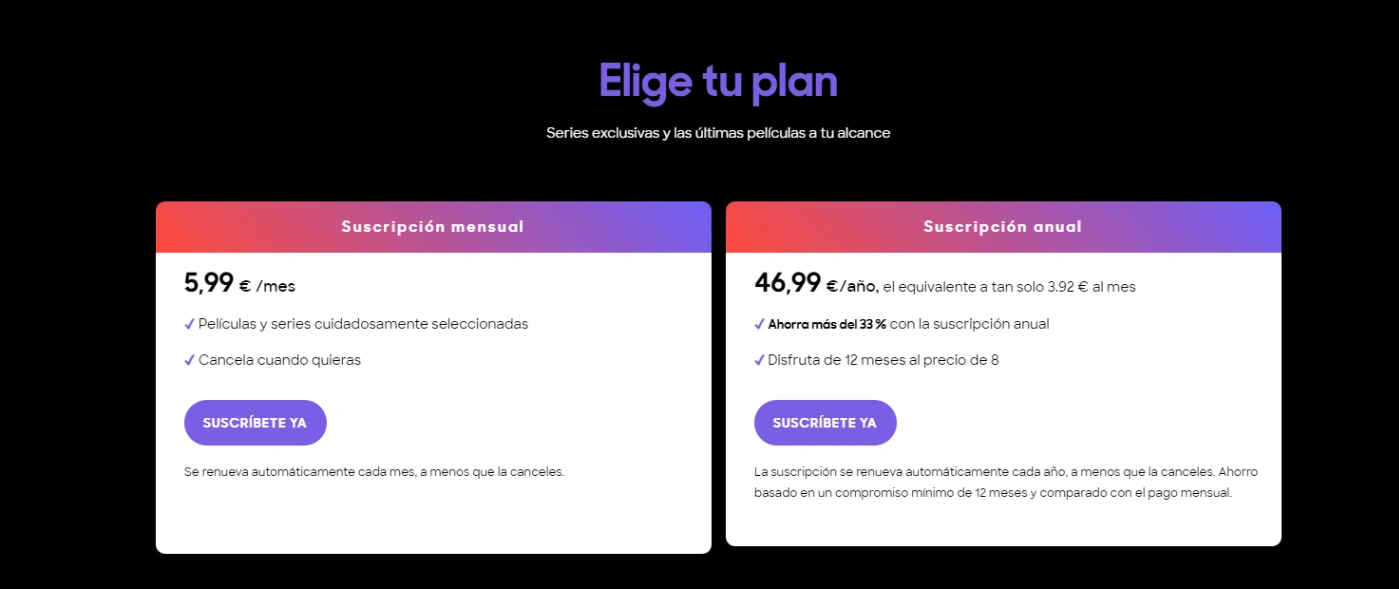

The next step is adding up all the costs of your subscriptions. Review each one and note down how much you pay periodically. Make sure to include any additional charges such as taxes or transaction fees for an accurate total expenditure calculation.

Once added up all costs from every subscription together; surprising may come at just how much money goes towards these on monthly/annual basis – information helpful evaluating importance each one life making informed decisions whether keep canceling them altogether!

For instance summing up realizing spending significant amount entertainment consider reducing number looking alternatives more economical instead keeping current ones active!

Consider Payment Frequency

Besides cost per individual case frequency payments made too matters some charge monthly while others annually even quarterly terms considered during calculations get precise image much really going out door every month year thus helping better manage budget plan future expenditures accordingly!

For example if annual payment made once-off important factor this into monthly budget ensure don't run out money other aspects life normally annual plans offer discount compared paying monthly basis!

Useful Tools Tracking Subscriptions

If find difficult manually track there several helpful tools make process easier here some options:

Subscription Tracking Apps

There mobile apps online tools let efficiently manage these apps control payments send reminders due dates analyze spending popular ones "Truebill" "SubscriptMe" "Bobby: Track Subscriptions".

In addition these many other market suit specific needs offering additional features like ability sync calendars receive personalized notifications explore choose fits requirements best!

Once selected desired app simply download device access website create account start adding detailed information enter name cost renewal date notes wish add then takes care automatically tracking upcoming renewals charges helping precise avoid forgetting unwanted anymore!

Other option share via Sharingful thus saving without having worry about when end!

Spreadsheets Tracking Subscriptions

If prefer using spreadsheet create own document using programs Microsoft Excel Google Sheets design template includes details update regularly keep accurate record spending customizable since design according preferences needs formulas functions calculations automatic sum total monthly calculate expiration dates greater data stored device cloud especially useful concerns privacy security personal remember matter chosen tool important regular review periodically evaluate remains necessary save unnecessary costs control effectively!

Tips Managing Subscription Expenses

After calculated time adopt measures effectively here practical tips help:

Assess Need Each Subscription

Look closely see really need use being offered rarely used interested anymore consider canceling reallocating elsewhere life priorities lie higher importance place set specific limit overspending non-essential revisiting adjusting needs priorities change over time forget clean ensuring relevance value preventing payments taking appropriate measures overall helps optimize ensuring used effective manner key finding balance enjoying provided ensuring contribute goals financial priorities!